- 4075879590

- processing@pronomus.com

- 8815 conroy windermere rd #145 Orlando Fl 32835

We help mortgage companies save resources, bolster operational bandwidth and compete at the highest level required to generate optimum efficiency in their mortgage processing.

testifies to our expertise in third-party mortgage loan processing services. We are a company that integrates intuitive technology with the technical expertise required to excel in the field.

we have standardized and automated mortgage processing services to offer back-office support that translates to reduced operational costs, improved data accuracy, and a quicker time to market. Mortgage lenders access our skilled staff to help stretch their operating bandwidth to handle up to 50% more volume in peak hours.

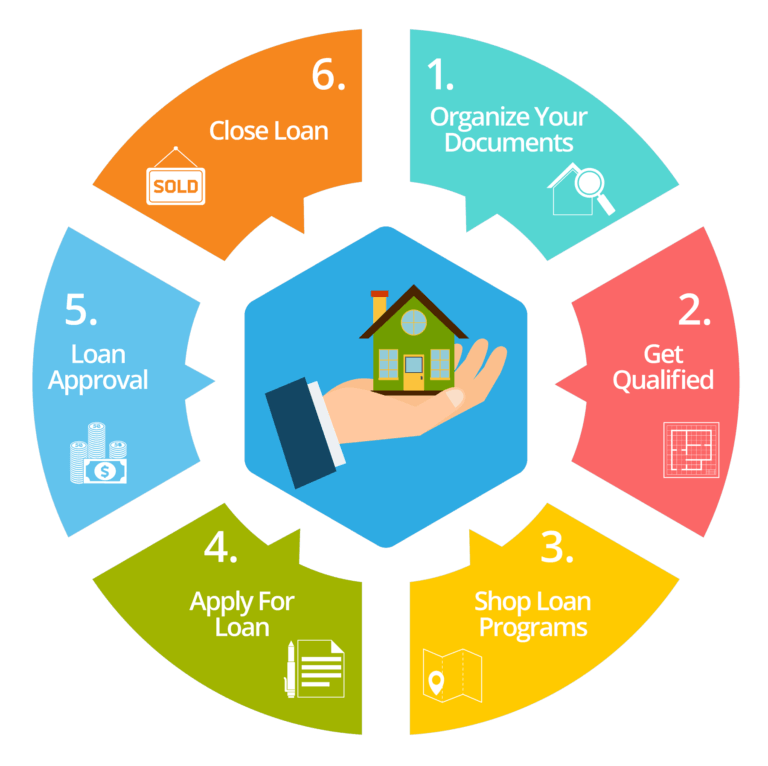

The experts at a mortgage processing company also help their clients put all their obligatory documents together. They can also go the extra mile in securing other important documents such as homeowner’s insurance for the property, among other things. A reputed company also can prepare and obtain documents like LE disclosures, flood certificate etc.

We go through all the loan documents including supporting customer documents, property details, appraisal reports and the underwriting reports to ensure that all information is in compliance with GSE and federal law regulations. We complete this process meticulously after which we arrange for title transfer in the mortgage post-closing process. Our attention to detail with document tracking and verification keeps your loan approval process audit ready at all times.